- #Cash flow spreadsheet excel how to#

- #Cash flow spreadsheet excel software#

- #Cash flow spreadsheet excel plus#

- #Cash flow spreadsheet excel professional#

Microsoft® Windows 7, Windows 8 or Windows 10īy downloading this software from our web site, you agree to the terms of our license agreement.ĬashFlowStatementTemplates.

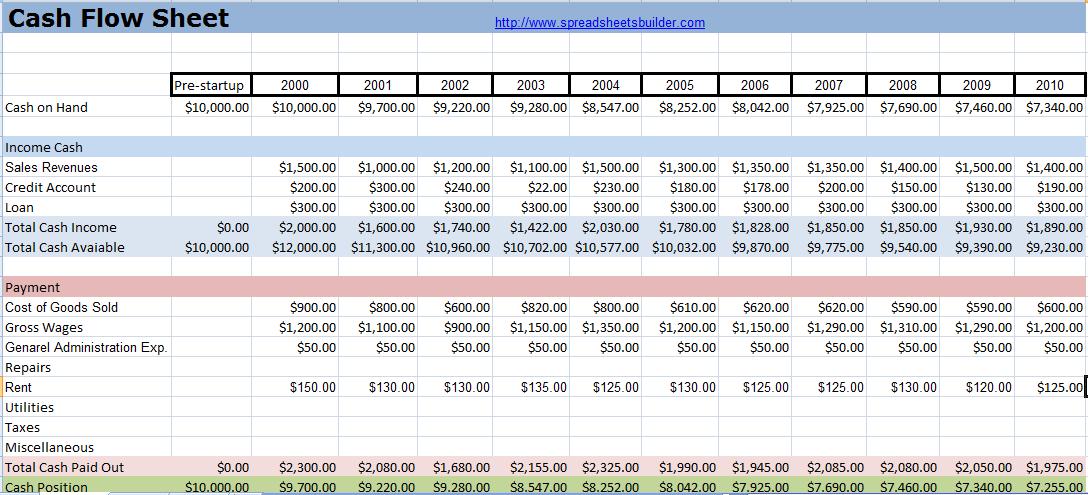

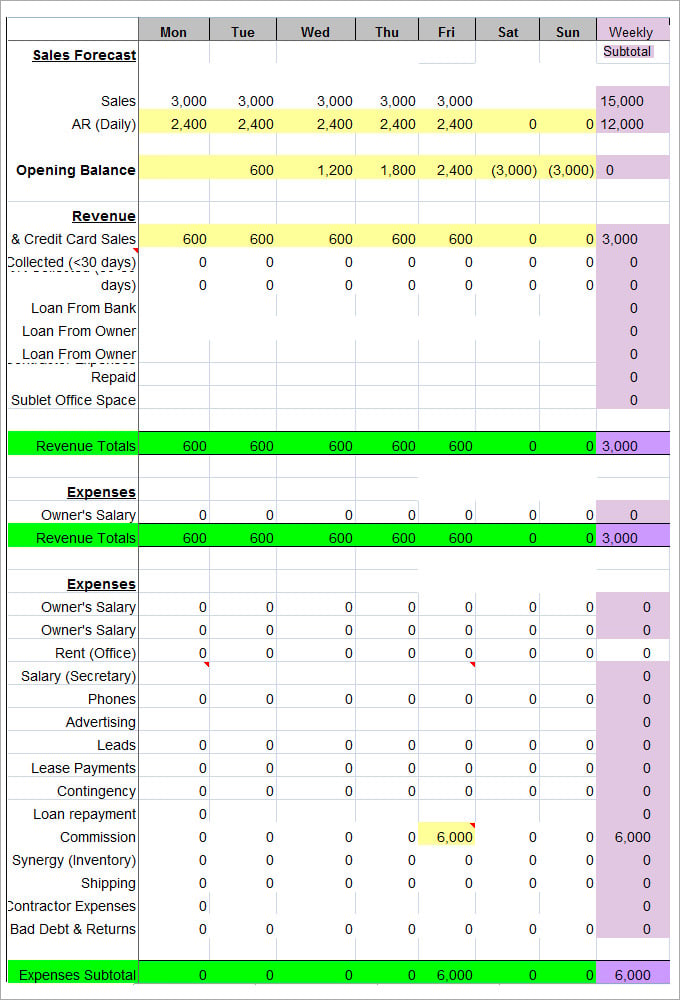

Many of the financial models created by ConnectCode use these balance sheet templates as a basis.ĭownload Free Cash Flow Statement spreadsheet - v1.0 System Requirements Reusing them is simply a matter of copy and paste. It includes both simple templates and slightly more complex and formatted templates. This set of Cash Flow Statement spreadsheet templates is designed for use by financial analysts in financial modeling. Investment cash flows - Cash flows relating to the sale or purchase of long-term assets.įinancing cash flows - Cash flows relating to the issuance of debt/equity, payment of dividends and payment of debt.Ĭash Flow Statements Spreadsheet templates For example, the cash flows relating to the selling of goods and services. Operational cash flows - Cash flows relating to the operation of the company's business. Cash Flow can be further categorized into Operational cash flows, Investment cash flows and Financing cash flows. This is also part of the calculation of Net Present Value, which is explained on a separate page.Free Cash Flow Statement Templates Cash Flow StatementĪ Cash Flow Statement is used to illustrate the movement of cash into and out of a company for a specified period of time. Your goal is to find the total value of all these future cash flows in present-day dollars, because that's what your investment is worth at a given rate of return (also known as the discount rate). As you operate your income property and when you sell it, you are generating cash flows.

Income properties' main way of producing value is through cash flows. Knowing the present value of an income property is vital to smart money management. And discounted cash flows show how much that decrease is. To summarize, the value of your money decreases when it's not immediately accessible by you. With a discounted cash flow, you can calculate the rate at which the value is decreasing. However, by calculating your compound interest, you can tell how the value is increasing. At the end of the second year, your principle and your interest combine to earn compounded interest.īy calculating your discounted cash flow, you can make an educated guess at what the value of your cash flow in a particular time in the future is worth to you in the present, similar to how you can calculate how much interest you'll earn on the money you put in your savings account by factoring the compound interest.

#Cash flow spreadsheet excel plus#

After that year is up, you have your original money (your principle) plus the interest that money earned throughout the year. Let's say you put money into a savings account and leave it alone for a year to let it earn interest.

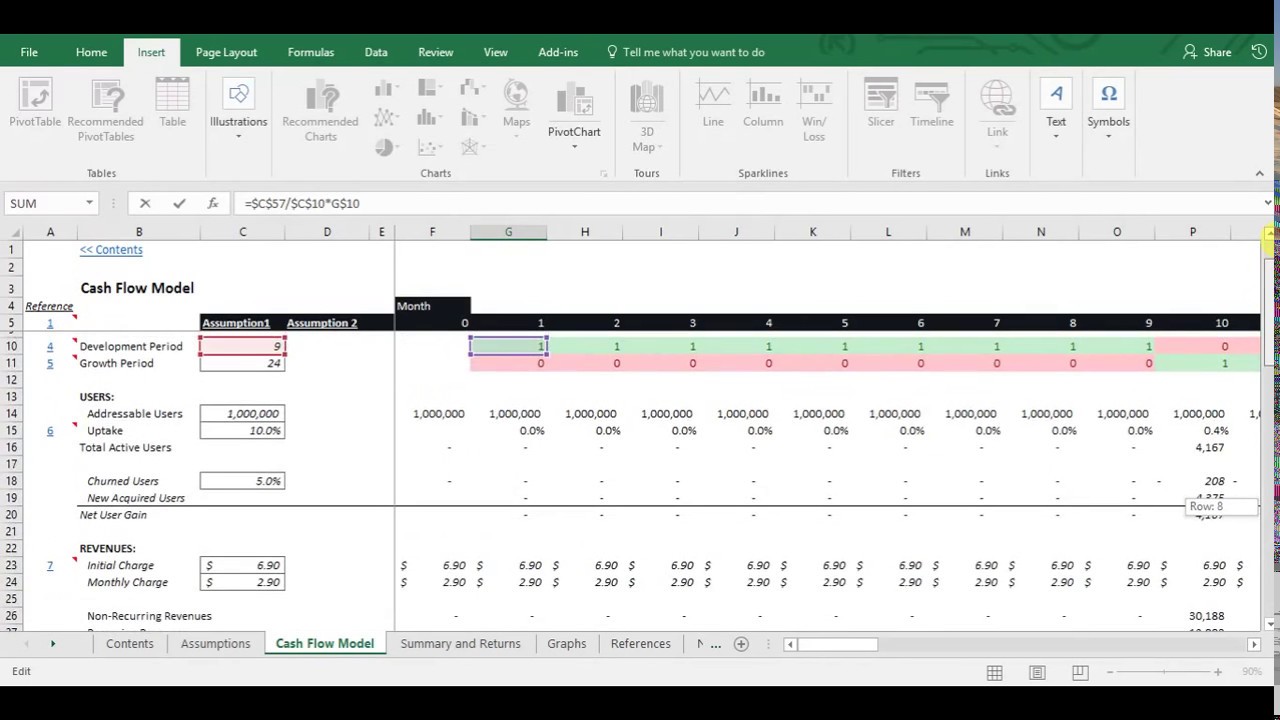

#Cash flow spreadsheet excel professional#

Your cash flow is always more valuable to you in the present because you can invest it and increase the amount you have.Ĭalculating a discounted cash flow is a little like calculating your savings account's compound interest. This excel template is great for those wanting a professional looking forecast 10 years of financial statements, those starting out as an entrepreneur. This is also known as the present value (PV) of a future cash flow.īasically, a discounted cash flow is the amount of future cash flow, minus the projected opportunity cost.

#Cash flow spreadsheet excel how to#

How to Calculate Discounted Cash Flow (DCF) Formula & Definitionĭiscounted Cash Flow is a term used to describe what your future cash flow is worth in today's value.

0 kommentar(er)

0 kommentar(er)